All Categories

Featured

Table of Contents

Any remaining excess belongs to the proprietor of record immediately prior to the end of the redemption duration to be claimed or assigned according to regulation - overages consulting. These amounts are payable ninety days after implementation of the act unless a judicial activity is set up during that time by an additional complaintant. If neither declared neither appointed within 5 years of day of public auction tax obligation sale, the overage shall escheat to the basic fund of the governing body

386, Areas 44, 49.C, eff June 14, 2006. Code Commissioner's Note 1997 Act No. 34, Section 1, directed the Code Commissioner to change all references to "Register of Mesne Conveyances" to "Register of Deeds" anywhere showing up in the 1976 Code of Regulations.

What Is The Most Valuable Training For Real Estate Investing Investors?

201, Part II, Section 49; 1993 Act No. 181, Area 231. SECTION 12-51-140. Notice to mortgagees. The provisions of Sections 12-49-1110 through 12-49-1290, comprehensive, associating with see to mortgagees of suggested tax obligation sales and of tax sales of properties covered by their corresponding home mortgages are adopted as a part of this phase.

Authorities may invalidate tax obligation sales. If the authorities in fee of the tax sale discovers before a tax obligation title has passed that there is a failure of any type of action called for to be appropriately carried out, the official might invalidate the tax sale and refund the quantity paid, plus passion in the quantity actually earned by the area on the amount refunded, to the effective bidder.

BACKGROUND: 1962 Code Section 65-2815.14; 1971 (57) 499; 1985 Act No. 166, Section 14; 2006 Act No. 386, Sections 35, 49. Code Commissioner's Note At the instructions of the Code Commissioner, the initial sentence as changed by Area 49.

Agreement with area for collection of tax obligations due municipality. A county and municipality might contract for the collection of metropolitan taxes by the region.

Overages System

He may use, select, or assign others to execute or perform the provisions of the chapter. BACKGROUND: 1962 Code Section 65-2815.16; 1971 (57) 499; 1985 Act No. 166, Area 16.

Tax obligation liens and tax obligation acts usually cost greater than the county's asking rate at auctions. Additionally, most states have laws impacting quotes that exceed the opening proposal. Repayments over the region's criteria are called tax obligation sale excess and can be rewarding investments. The information on overages can create issues if you aren't aware of them.

In this write-up we tell you how to obtain lists of tax obligation excess and generate income on these properties. Tax obligation sale overages, also called excess funds or superior quotes, are the amounts quote over the beginning rate at a tax auction. The term refers to the dollars the investor invests when bidding process above the opening bid.

What Are The Key Takeaways From Investment Training Courses?

The $40,000 increase over the initial proposal is the tax sale overage. Asserting tax obligation sale excess implies getting the excess cash paid throughout a public auction.

That said, tax sale overage claims have shared attributes throughout the majority of states. During this duration, previous owners and home mortgage holders can get in touch with the county and get the overage.

Which Course Is The Top Choice For Investors In Investment Training?

If the duration expires before any interested celebrations assert the tax obligation sale overage, the area or state generally soaks up the funds. When the money mosts likely to the federal government, the opportunity of declaring it disappears. As a result, past owners get on a strict timeline to claim overages on their homes. While excess typically don't equate to higher profits, investors can benefit from them in numerous means.

Remember, your state laws influence tax obligation sale overages, so your state may not permit capitalists to collect overage interest, such as Colorado. Nonetheless, in states like Texas and Georgia, you'll earn passion on your whole quote. While this aspect does not indicate you can assert the excess, it does assist mitigate your expenses when you bid high.

Bear in mind, it might not be lawful in your state, suggesting you're restricted to collecting passion on the excess - tax lien. As specified above, a financier can discover methods to benefit from tax obligation sale overages. Because rate of interest revenue can relate to your entire proposal and past owners can assert overages, you can take advantage of your knowledge and tools in these circumstances to make the most of returns

As with any kind of financial investment, study is the crucial opening step. Your due persistance will give the necessary understanding into the homes offered at the following auction. Whether you make use of Tax obligation Sale Resources for financial investment data or call your area for info, a thorough evaluation of each property allows you see which buildings fit your investment design. An essential element to remember with tax obligation sale overages is that in the majority of states, you just require to pay the region 20% of your complete proposal up front., have legislations that go past this policy, so once again, study your state regulations.

How Does Bob Diamond Define Success In Recovery?

Rather, you just require 20% of the proposal. Nevertheless, if the residential or commercial property does not redeem at the end of the redemption period, you'll require the continuing to be 80% to obtain the tax act. Since you pay 20% of your quote, you can make passion on an excess without paying the complete cost.

Again, if it's lawful in your state and county, you can collaborate with them to help them recoup overage funds for an added charge. You can collect rate of interest on an overage proposal and charge a cost to streamline the overage case process for the previous owner. Tax Sale Resources just recently launched a tax obligation sale excess item specifically for individuals interested in going after the overage collection company.

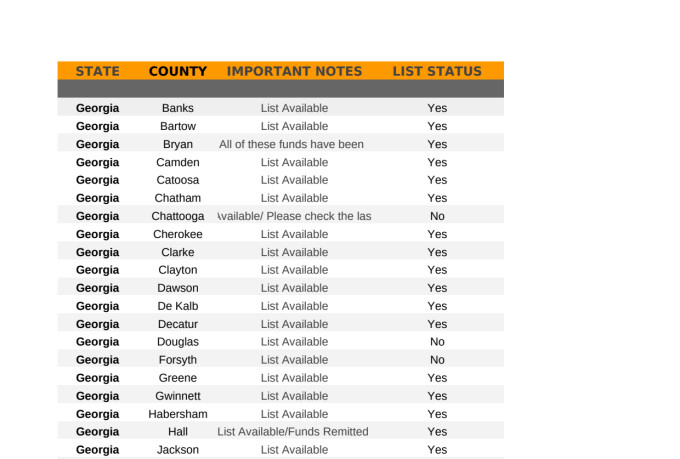

Overage enthusiasts can filter by state, region, residential property kind, minimal overage quantity, and maximum overage amount. When the information has actually been filteringed system the enthusiasts can choose if they wish to add the miss mapped information bundle to their leads, and then spend for just the confirmed leads that were located.

Overages Education

To obtain begun with this game altering product, you can find out much more below. The finest method to get tax sale excess leads Concentrating on tax sale overages rather of standard tax lien and tax action investing calls for a details technique. Furthermore, much like any type of other financial investment method, it provides one-of-a-kind advantages and disadvantages.

Latest Posts

Investing In Tax Lien Certificates For Beginners

Tax Lien Homes Near Me

How To Tax Lien Investing